Business Insurance in and around Summit

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- Springfield

- Union County

- Summit

- Chatham

- Essex County

- Somerset County

- Hudson County

This Coverage Is Worth It.

Operating your small business takes effort, hard work, and quality insurance. That's why State Farm offers coverage options like worker's compensation for your employees, business continuity plans, errors and omissions liability, and more!

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

At State Farm, apply for the great coverage you may need for your business, whether it's an art gallery, an interior decorator or a cosmetic store. Agent Glisel Jimenez is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

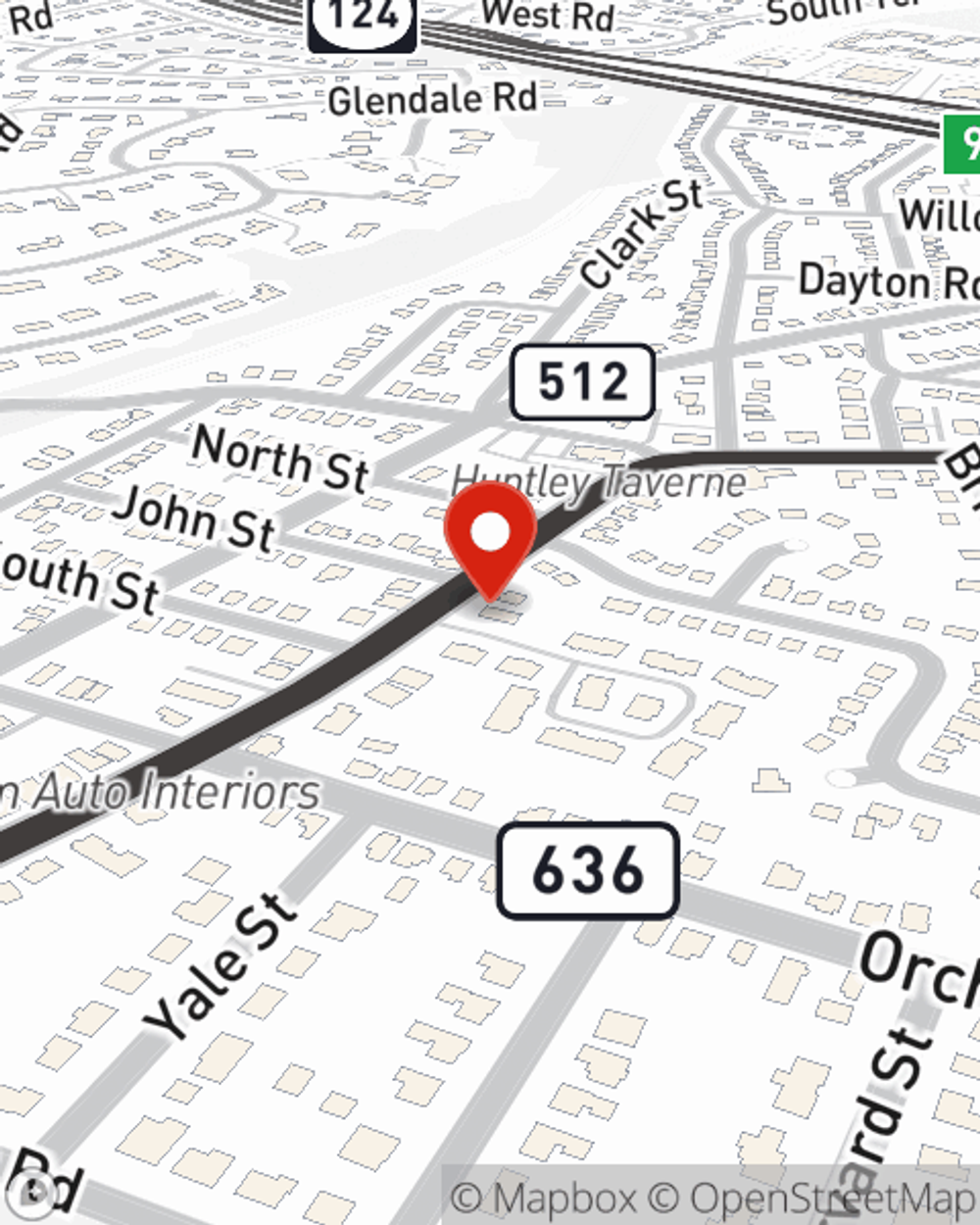

Ready to consider the business insurance options that may be right for you? Visit agent Glisel Jimenez's office to get started!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Glisel Jimenez

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.