Renters Insurance in and around Summit

Your renters insurance search is over, Summit

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Springfield

- Union County

- Summit

- Chatham

- Essex County

- Somerset County

- Hudson County

Home Sweet Home Starts With State Farm

Think about all the stuff you own, from your desk to laptop to books to hiking shoes. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Summit

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps protect your personal possessions in case of the unexpected.

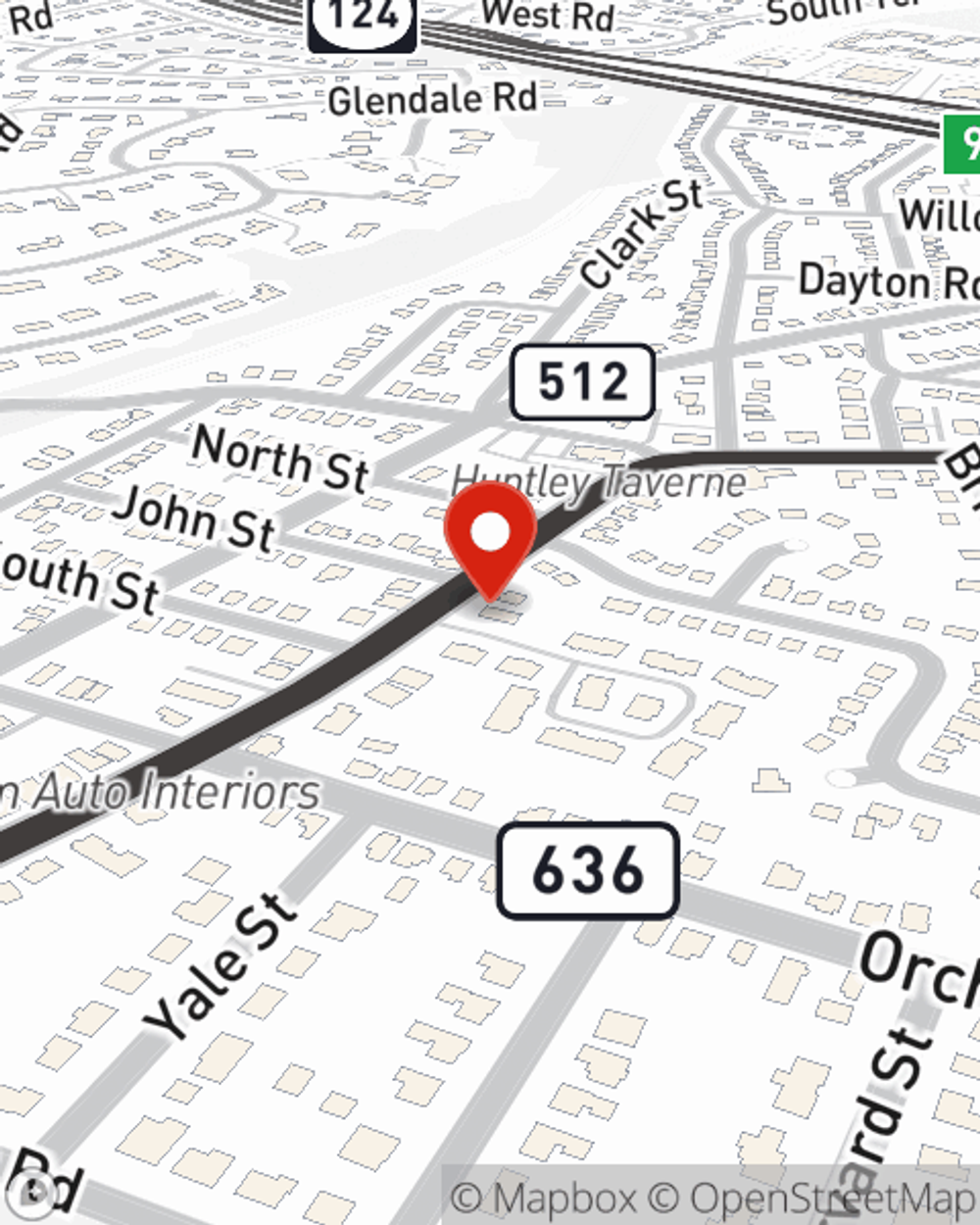

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Summit. Contact agent Glisel Jimenez's office to learn more about a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Glisel at (908) 277-4099 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Glisel Jimenez

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.